Property Tax Savings Can Help You Stay in Your Home

In my AgeWise articles in February and March, I shared information about ways to save money. As the infomercials say, “But wait! There’s more!”

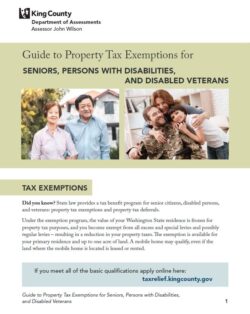

Click on the image above to open the King County Guide to Property Tax Exemptins for Seniors, Persons with Disabilities, and Disabled Veterans.

One of the biggest savings available to older people with low to moderate income comes through Washington State’s Senior Property Tax Exemption program, which is administered in King County by the King County Department of Assessments.

I love to provide examples, and a recent one comes from an article called “Underused programs could assist with older Washingtonians’ budgets” (Public News Service, 12/1/2023): “King County Assessor John Wilson cited the median value for a home in his county was about $790,000. If someone qualifies for a full exemption, Wilson estimates they would save almost $5,000 a year.” That’s quite a savings! The program is designed to help you stay in your home.

Please note that savings will vary depending on the area in which you live and the property taxes, levies, and residential values in effect in that area.

I want to be very clear that I’m talking about a property tax exemption program, not a tax deferral program. I know a lot of people who are confused about the two. The exemption program freezes your taxes, and no money needs to be paid back in the future. The other program doesn’t change the amount owed; it simply defers the payment.

Currently, to qualify for the property tax exemption program, your annual income must be under $84,000, including Social Security and other sources. You must be at least age 62 the first year you apply (or you are retired due to a disability or you are a veteran with a service-related disability). There are also ownership and occupancy requirements.

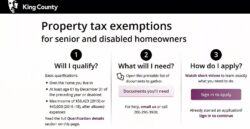

To apply, visit King County’s Senior Exemption Portal. But before that, I recommend that you watch the video linked at right so you know what to expect—what it takes to qualify, what document you will need, and an overview of the application process. (I note that the video is a little dated but still provides valid process information.) Once you’ve collected the information you need—and what better time than when you’re filing your annual taxes!—return to the portal link above and complete the online form.

You’ll find a lot of useful tips in the portal, too, including this: You can apply for more than one year, going back three years, as long as you were eligible. You will need a separate application for each year. Imagine the potential savings or refund over multiple years!

King County Assessor’s Office staff are willing to come to your local community or senior center to give a presentation about the program, if you would like to hear more and ask questions. For more information, e-mail Exemptions.Assessments@kingcounty.gov or call 206-296-3920.

Speaking of taxes, with the April 15 deadline looming, don’t forget that you can get free help completing the forms via United Way Free Tax Prep or AARP Foundation Tax-Aide, both of which have published recent AgeWise articles (click the links for more information).

Contributor Alex O’Reilly chairs the Seattle-King County Advisory Council on Aging & Disability Services. She welcomes input from readers via e-mail (advisorychair@agewisekingcounty.org).

Contributor Alex O’Reilly chairs the Seattle-King County Advisory Council on Aging & Disability Services. She welcomes input from readers via e-mail (advisorychair@agewisekingcounty.org).

This article appeared in the April 2024 issue of AgeWise King County.

![Aging & Disability Services for Seattle & King County [logo]](https://www.agingkingcounty.org/wp-content/themes/sads/images/seattle-ads-logo.png)