Get Free Help Preparing Your Taxes, Increase Your Return

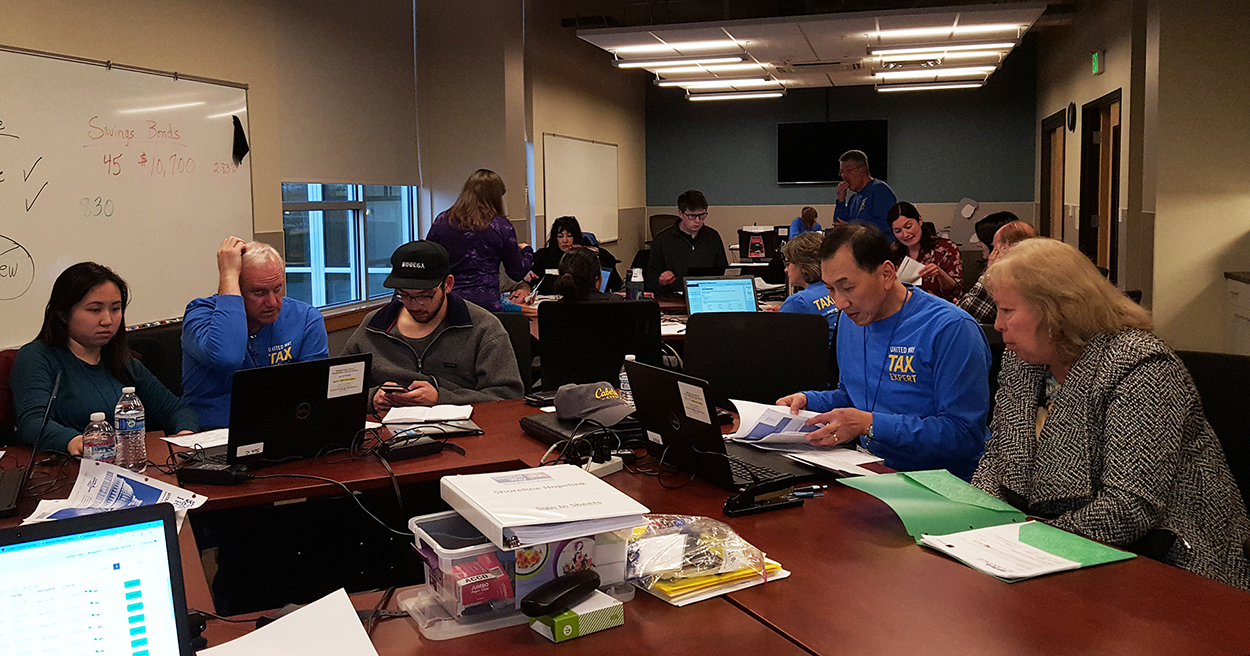

Another year, another stack of tax forms arriving in your mailbox … do you have a plan for tax season? Or would you rather not be the one to have to deal with it? Don’t worry—United Way of King County is here to help.

Every year, United Way’s Free Tax Volunteer Team offers free tax preparation services at one of many sites in the Puget Sound region. This year, we have 20 in-person locations, as well as a virtual tax site, where you can go to get your taxes filed. And if you’re behind on your taxes, we can help with that, too. We can file back taxes through to 2018.

Did you receive your stimulus checks in 2020? If you didn’t, this is the last year you will be able to apply for those payments, and we can help with that too.

Did you receive your stimulus checks in 2020? If you didn’t, this is the last year you will be able to apply for those payments, and we can help with that too.

Visit FreeTaxExperts.org for information about our services and a map showing locations of our Free Tax Prep sites and hours of operation.

Wondering about eligibility?

This year’s Free Tax Prep income thresholds are $80,000 for single individuals without dependents and $96,000 for other filing statuses (married, with or without dependents, or single with dependents). We can prepare your taxes if you have income that is reported via a W-2, 1099 self-employment income, cash income, retirement, Social Security, interest and/or stocks (although we request that you bring along a summary page for your stock earnings).

For information about the types of returns that we are not able to prepare, go to www.uwkc.org/need-help/tax-help/ and scroll down to the General Eligibility section as well as the FAQs.

We hope to see you this season. Best wishes from the United Way of King County Free Tax Team!

Contributor Casey Lantz is the Outreach and Relationship Coordinator, Tax Credits and Financial Stability, at United Way of King County.

Contributor Casey Lantz is the Outreach and Relationship Coordinator, Tax Credits and Financial Stability, at United Way of King County.

This article appeared in the February 2024 issue of AgeWise King County.

![Aging & Disability Services for Seattle & King County [logo]](https://www.agingkingcounty.org/wp-content/themes/sads/images/seattle-ads-logo.png)